5 Types of Coverage Every Driver Should Have

Learn about 5 types of coverage every driver should have and how it affects your legal rights after a car accident. Get expert advice from experienced car accident attorneys.

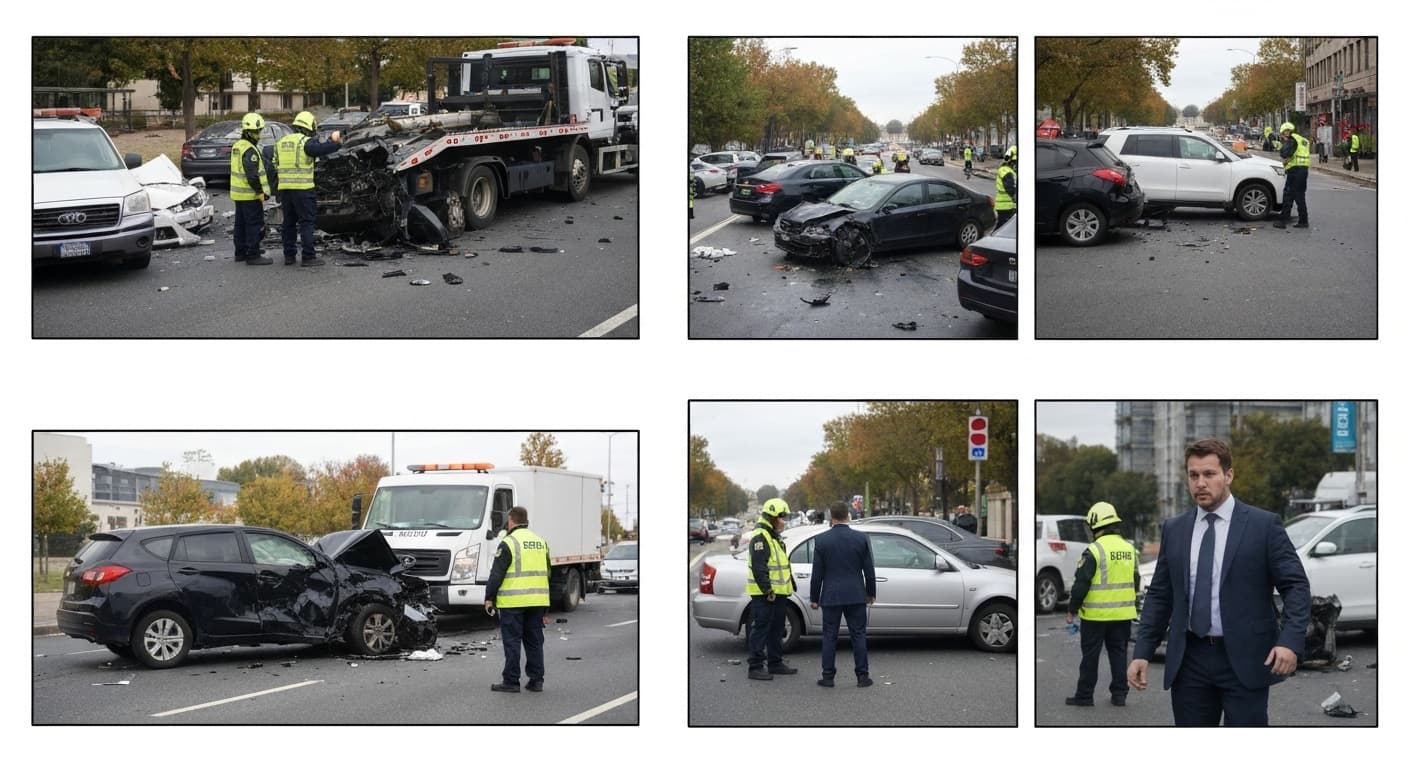

# 5 Types of Coverage Every Driver Should Have

Auto insurance is a complex and often confusing topic, with numerous coverage options that can provide critical protection in different accident scenarios. Understanding the essential types of coverage every driver should have can help protect you, your passengers, and your financial well-being in case of an accident. While state minimum requirements vary, comprehensive coverage goes beyond basic liability to provide complete protection. An experienced car accident attorney can help you understand your coverage and navigate claims when accidents occur.

Understanding Basic Coverage Requirements

State Minimum Requirements

Financial Responsibility Laws

- Bodily injury liability coverage minimum amounts

- Property damage liability coverage requirements

- Personal injury protection availability in no-fault states

- Uninsured/underinsured motorist coverage access

State-Specific Variations

- Minimum coverage amount differences by jurisdiction

- Required coverage type variations between states

- Tort vs. no-fault system coverage implications

- Compulsory coverage enforcement mechanisms

Beyond Minimum Coverage Importance

Adequate Protection Assessment

- Personal asset protection requirement evaluation

- Injury severity potential consideration

- Property value and replacement cost assessment

- Future medical expense projection needs

Coverage Type 1: Bodily Injury Liability

Coverage Fundamentals

Liability Coverage Purpose

- Compensation for injuries caused to others in accidents

- Medical expense coverage for injured parties

- Lost income reimbursement for accident victims

- Pain and suffering damage responsibility

Coverage Limit Considerations

- Per-person injury limit requirement assessment

- Per-accident total limit determination needs

- State minimum vs. recommended limit comparisons

- Personal asset protection level evaluation

When You Need This Coverage

At-Fault Accident Scenarios

- Medical bills for injured parties coverage provision

- Lost wages reimbursement responsibility handling

- Pain and suffering damage compensation coverage

- Rehabilitation expense coverage inclusion

Legal Requirement Implications

- Financial responsibility demonstration for licensing

- Court-ordered payment capability maintenance

- Settlement negotiation leverage provision

- Lawsuit defense cost protection

Coverage Type 2: Property Damage Liability

Damage Coverage Essentials

Property Protection Scope

- Vehicle damage to other vehicles compensation

- Personal property damage coverage inclusion

- Roadside property and structure damage responsibility

- Cargo and load damage liability provision

Coverage Amount Determination

- State minimum requirement compliance

- Vehicle value-based limit consideration

- Comprehensive protection level assessment

- Deductible amount evaluation

Claim Processing Considerations

Damage Assessment Requirements

- Professional appraisal utilization for fair value

- Repair cost vs. replacement value determination

- Diminished value consideration in settlements

- Salvage value accounting in total loss scenarios

Coverage Type 3: Collision Coverage

Physical Damage Protection

Collision Incident Coverage

- Vehicle damage from collision with another vehicle

- Single-vehicle accident damage coverage

- Rollover and upset incident protection

- Fixed object collision coverage provision

Coverage Limitations and Considerations

- Deductible amount requirement impact

- Actual cash value vs. agreed value policy differences

- Wear and tear exclusion awareness

- Diminished value claim potential

Economic Considerations

Cost-Benefit Analysis

- Premium cost vs. protection value assessment

- Vehicle age and value influence on decision-making

- Loan/lease requirement evaluation

- Comprehensive coverage comparison consideration

Coverage Type 4: Comprehensive Coverage

Non-Collision Damage Protection

Covered Incident Types

- Theft and vandalism damage coverage

- Weather-related vehicle damage protection

- Falling object impact coverage provision

- Animal collision damage reimbursement

Policy Integration Benefits

- Collision coverage complementary protection

- Comprehensive risk management approach

- Premium bundling cost-saving potential

- Deductible coordination advantage

Claim Frequency and Value

Common Claim Scenarios

- Parking lot vehicle damage situations

- Weather event vehicle protection needs

- Vandalism and theft incident coverage

- Hail and wind damage reimbursement

Coverage Type 5: Uninsured/Underinsured Motorist Coverage

Unprotected Driver Protection

Coverage Gap Filling Purpose

- Uninsured driver accident protection provision

- Underinsured driver coverage gap compensation

- Hit-and-run incident coverage availability

- Minimum liability limit violation protection

Coverage Structure Components

- Bodily injury uninsured motorist coverage

- Property damage uninsured motorist protection

- Underinsured motorist bodily injury coverage

- Underinsured motorist property damage protection

Economic Protection Value

Financial Security Benefits

- Personal injury protection in uninsured incidents

- Medical expense coverage without other party payment

- Lost income reimbursement capability

- Pain and suffering damage compensation availability

Legal and Practical Considerations

State Availability Variations

- Required coverage in some state jurisdictions

- Optional coverage in other state systems

- Stacking provision availability consideration

- Arbitration requirement awareness

Additional Essential Coverages

Personal Injury Protection (PIP)

No-Fault State Requirements

- Medical expense coverage up to policy limits

- Lost wage reimbursement provision

- Essential services payment coverage

- Rehabilitation expense reimbursement

Medical Payments Coverage

Supplemental Medical Protection

- Medical expense payment without fault determination

- Ambulance and emergency service coverage

- Hospital and medical treatment-payment inclusion

- Prescription medication cost coverage

New Vehicle Replacement Coverage

Enhanced Vehicle Protection

- New vehicle actual cash value protection

- Depreciation adjustment elimination benefits

- Loan/lease payoff coverage advantages

- Premium cost vs. protection value consideration

Coverage Coordination and Stacking

Policy Integration Strategies

Multiple Policy Utilization

- Primary and secondary coverage coordination

- Umbrella policy integration potential

- Commercial and personal policy combination

- Family member coverage inclusion consideration

Coverage Limit Optimization

Limit Assessment Methodology

- Income-based limit determination approach

- Asset protection requirement evaluation

- Injury severity potential consideration

- Future medical expense projection inclusion

Cost Management Strategies

Premium Optimization Approaches

Discount Availability Assessment

- Safe driver discount eligibility verification

- Multi-policy bundling discount opportunities

- Defensive driving course completion benefits

- Deductible amount adjustment consideration

Coverage Customization Methods

- Coverage limit adjustment based on needs

- Seasonal coverage utilization opportunities

- Payment plan optimization strategies

- Annual policy review and adjustment practices

State-Specific Coverage Variations

Geographical Coverage Differences

No-Fault State Systems

- Personal injury protection requirement mandates

- Verbal threshold compliance considerations

- Tort option availability evaluation

- Coordination of benefit provision assessment

Tort State Requirements

- Minimum liability coverage compulsory amounts

- Fault determination system compliance

- Comparative negligence rule application

- Uninsured motorist coverage availability

Making Informed Coverage Decisions

Risk Assessment Process

Personal Situation Evaluation

- Driving frequency and mileage consideration

- Vehicle value and replacement cost assessment

- Family size and protection need determination

- Geographic location risk factor evaluation

Insurance Agent Consultation Benefits

Professional Guidance Value

- Coverage option explanation and clarification

- Personal situation customization assistance

- State requirement compliance verification

- Cost comparison and optimization support

Conclusion: Comprehensive Protection Planning

Auto insurance coverage is a critical component of responsible vehicle ownership, providing essential protection against financial loss in accident scenarios. Understanding the five essential coverage types—bodily injury liability, property damage liability, collision, comprehensive, and uninsured/underinsured motorist coverage—can help you make informed decisions about your protection level. While state minimums provide basic requirements, comprehensive coverage ensures complete protection for you, your passengers, and other accident victims.

When shopping for auto insurance, consider your driving habits, vehicle value, and financial situation to determine appropriate coverage limits. Remember that insurance is about risk management, and adequate coverage provides peace of mind and financial security.

If youve been involved in an accident and need help understanding your coverage or pursuing a claim, contact an experienced car accident attorney immediately. Most attorneys offer free consultations and work on contingency fees, meaning you pay nothing unless they win your case. Protect your rights and ensure you receive the compensation you deserve.