Can you sue someone for lying about a car accident?

Learn about can you sue someone for lying about a car accident? and how it affects your legal rights after a car accident. Get expert advice from experienced car accident attorneys.

# Can You Sue Someone for Lying About a Car Accident?

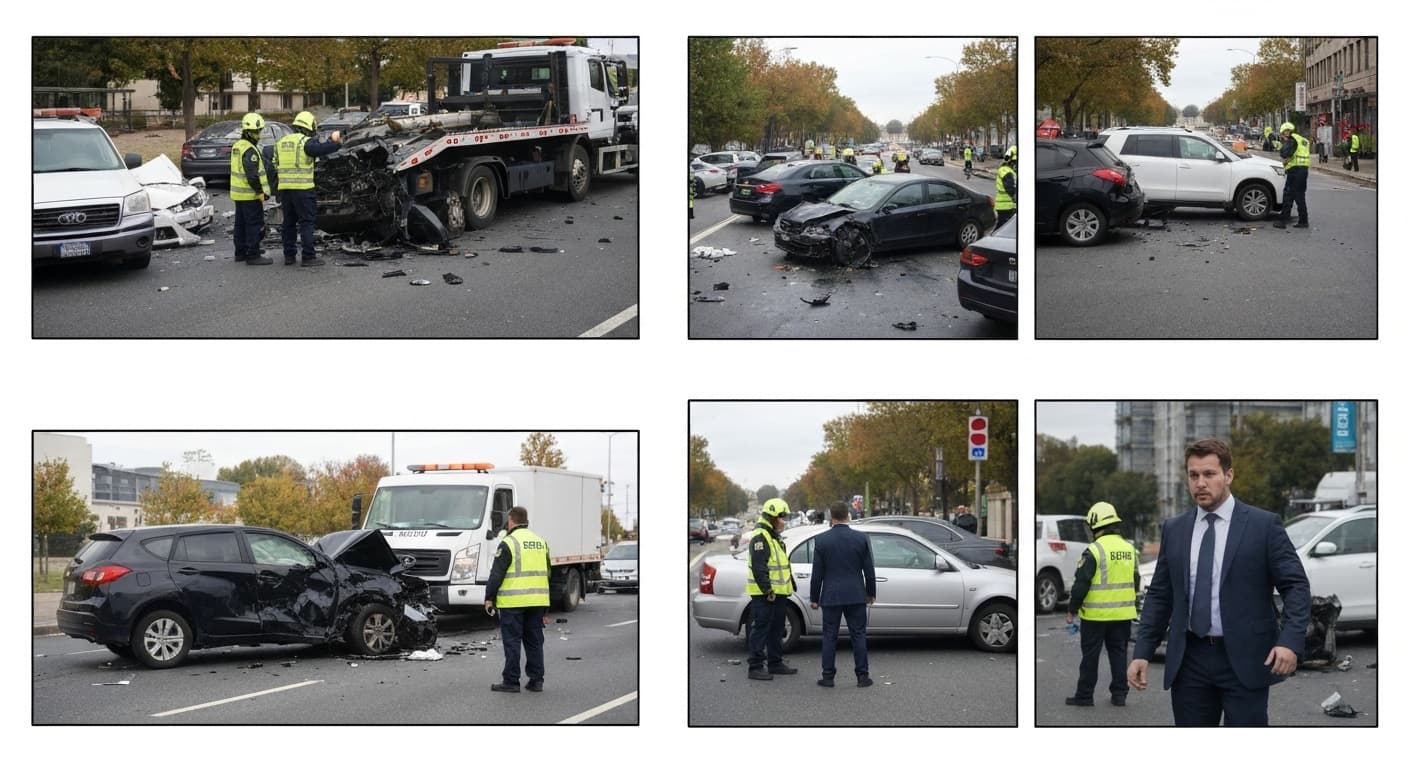

Car accidents are stressful enough without dealing with dishonesty from the other party involved. Unfortunately, some people lie about the circumstances surrounding an accident, which can complicate your insurance claim and personal injury case. Understanding whether you can sue someone for lying about a car accident requires knowledge of legal principles, evidence requirements, and the civil justice system. If youve been involved in an accident where the other party lied about what happened, an experienced car accident attorney can help you explore your legal options and pursue appropriate remedies.

Understanding Lies in Car Accident Contexts

Lying about a car accident can take many forms and have significant legal consequences. Whether its exaggerating injuries, denying fault, or fabricating details, dishonesty can affect your ability to receive fair compensation and may be actionable under civil law.

Common Types of Lies in Accidents

Fabricated Details

- Completely made-up circumstances about how the accident occurred

- False claims about vehicle damage or collision location

- Invented witness statements or involvement

- Misrepresented pre-accident vehicle conditions

Exaggerated Claims

- Inflated injury severity or treatment needs

- Overstated property damage or repair costs

- Fabricated lost wages or income claims

- Misrepresented pain and suffering damages

Legal Basis for Suing Over Lies

Fraud and Misrepresentation Laws

Civil Fraud Requirements

- Intentional misrepresentation of facts

- Reasonable reliance on the false information

- Resulting damages from the deception

- Proof of materiality to the case outcome

Insurance Fraud Considerations

- Policy violation through false statements

- Criminal charges in extreme cases

- Civil liability for economic losses

- Bad faith insurance claim potential

Defamation and Slander Claims

False Statement Elements

- Published or communicated false statements

- Harm to your reputation or professional standing

- Lack of privilege or protection for the statements

- Actual damages resulting from the falsehood

Witness Statement Complications

- Perjury charges for sworn testimony

- Civil liability for defamation of character

- Counterclaims complicating your original case

Evidence Requirements and Challenges

Proving Intentional Deception

Documentary Evidence Needs

- Inconsistent statements across different accounts

- Contradicting police reports or official records

- Surveillance footage or witness testimony

- Vehicle damage analysis expert opinions

Circumstantial Evidence Challenges

- Establishing motive for the deception

- Timeline inconsistencies in statements

- Physical evidence contradicting claims

- Expert witness testimony requirements

Insurance Company Investigation Complications

Adjuster Statement Analysis

- Recorded statement review for inconsistencies

- Multiple interview comparison analysis

- Documentation verification requirements

- Timeline reconstruction challenges

Potential Legal Remedies

Civil Lawsuit Options

Damage Categories

- Economic loss compensation for increased claim costs

- Emotional distress damages from dealing with deception

- Punitive damages for egregious dishonesty

- Attorneys fee recovery in successful fraud cases

Injunction and Declaratory Relief

- Court orders requiring truthful statements

- Legal declarations establishing actual facts

- Policy rescission or claim denial prevention

- Enforcement of honest claim handling

Criminal Prosecution Considerations

Felony Fraud Thresholds

- Significant financial loss amounts (often $5,000+)

- Repeat offender status consideration

- Organized fraud scheme involvement

- Aggravating circumstances presence

Misdemeanor Offenses

- Smaller claim value deceptions

- First-time offender classification

- Lesser financial harm amounts

- Mitigating circumstance consideration

Statute of Limitations Considerations

Time Limits for Fraud Claims

Discovery Rule Application

- Fraud discovery date as claim starting point

- Reasonable diligence requirement in uncovering deception

- Extended timelines for hidden fraud

- Due diligence investigation responsibilities

State-Specific Variations

- Different limitation periods by jurisdiction

- Tolling provisions for ongoing fraud

- Longer statutes for criminal investigations

- Civil claim coordination requirements

Practical Challenges in Fraud Cases

Proof of Intent Burden

Knowledge and Intent Requirements

- Awareness of statement falsity demonstration

- Purposeful deception motive establishment

- Willful blindness principle application

- Reckless disregard evidence threshold

Evidence Preservation Difficulties

Digital and Physical Evidence

- Social media post collection challenges

- Surveillance footage retention requirements

- Witness cooperation and testimony issues

- Expert analysis coordination needs

Insurance Company Response Considerations

Policy Fraud Exclusions

Standard Insurance Provisions

- Fraud detection and investigation authority

- Claim denial rights for proven misrepresentation

- Settlement withholding during investigation

- Fraud-related litigation cost coverage

Good Faith Settlement Requirements

Reasonable Investigation Standards

- Proper claim handling duty requirements

- Fair dealing obligation compliance

- Settlement offer reasonableness evaluation

- Documentation completeness maintenance

When to Consult an Attorney

Early Warning Signs

Initial Red Flags

- Inconsistent accident account statements

- Reluctance to provide requested information

- Pressure to settle quickly without investigation

- History of similar claim complications

Mid-Case Concern Indicators

- Changing stories during investigation

- Missing witness or evidence introduction

- Insurance company claim denial suggestions

- Expert testimony contradictions

Attorney Role Assessment

Investigation Coordination

- Evidence gathering strategy development

- Expert witness engagement planning

- Timeline preservation management

- Legal documentation preparation

Strategy Development

- Fraud claim viability assessment

- Damages calculation and documentation

- Settlement negotiation preparation

- Trial strategy contingency planning

Alternative Dispute Resolution

Mediation and Arbitration Benefits

Mediation Advantages

- Confidential dispute resolution process

- Cost-effective alternative to litigation

- Flexible outcome possibility exploration

- Preserved relationship maintenance potential

Arbitration Considerations

- Binding decision requirements understanding

- Limited appeal option awareness

- Cost comparison with court proceedings

- Procedural formality differences

Prevention and Protection Strategies

Immediate Post-Accident Actions

Evidence Preservation

- Scene photograph and video documentation

- Witness contact information collection

- Official report filing and record retention

- Personal injury and treatment documentation

Insurance Claim Best Practices

Honest and Thorough Reporting

- Complete and accurate information provision

- Supporting documentation preparation

- Professional attorney consultation scheduling

- Timeline and process expectation management

Economic Considerations in Fraud Claims

Cost-Benefit Analysis

Financial Investment Required

- Investigation and evidence collection expenses

- Expert witness and testimony costs

- Legal fee accumulation during proceedings

- Potential counterclaim defense costs

Recovery Potential Evaluation

- Fraud damages calculation methodology

- Punitive damage possibility assessment

- Insurance bad faith claim inclusion

- Overall economic impact consideration

Insurance Coverage Impact

Personal Auto Policy Effects

- Increased premium consequences

- Underwriting consideration changes

- Future claim handling complexity

- Renewal possibility complications

Long-Term Implications

Reputation and Future Impact

Professional and Personal Consequences

- Industry reputation damage potential

- Future insurance availability challenges

- Employment and licensing complication risks

- Civil judgment and record effects

Legal Precedent Establishment

Case Law Development

- Similar fraud case outcome influences

- Insurance industry practice changes

- Consumer protection advancement potential

- Deterrent effect on dishonest practices

Conclusion: Weighing Your Options

While you can sue someone for lying about a car accident, success depends on evidence strength, legal jurisdiction, and fraud severity. Fraud claims require substantial proof and carry significant costs and risks. Before pursuing legal action for fraud, consult with an experienced car accident attorney who can evaluate your specific situation and help determine the best course of action.

An experienced attorney can assess whether the fraud is actionable, help gather necessary evidence, and guide you through the complex legal process. Most car accident attorneys work on contingency fees, meaning you pay nothing unless they win your case.

If you believe someone has lied about a car accident involving you, dont delay. Contact a qualified car accident attorney immediately to discuss your situation and explore your legal options. Protect your rights and ensure you receive the fair compensation you deserve.